LUCERNE U.S. FARMLAND PLATFORM

Navigate The $3.6 Trillion Farmland Opportunity With Clarity

A comprehensive paper providing an institutional perspective on agricultural real assets.

Request Early Access To Our 2026 Farmland Investment Insights Primer

Institutional Research on U.S. Farmland Investing

This comprehensive institutional primer provides the frameworks and insights you need to evaluate farmland as an alternative asset class, from market fundamentals and owner-operator advantages to portfolio integration strategies.

Inside You'll Find:

- Correlation analysis of farmland versus other asset classes

- Introduction to investment strategies and crop types

- Analysis of farmland investment management models: Owner-operator vs. lease-back economic comparison

- Market structure analysis across crop types and geographies

- Risk management approaches at both asset and portfolio levels

Our Regenerative Farmland Focus

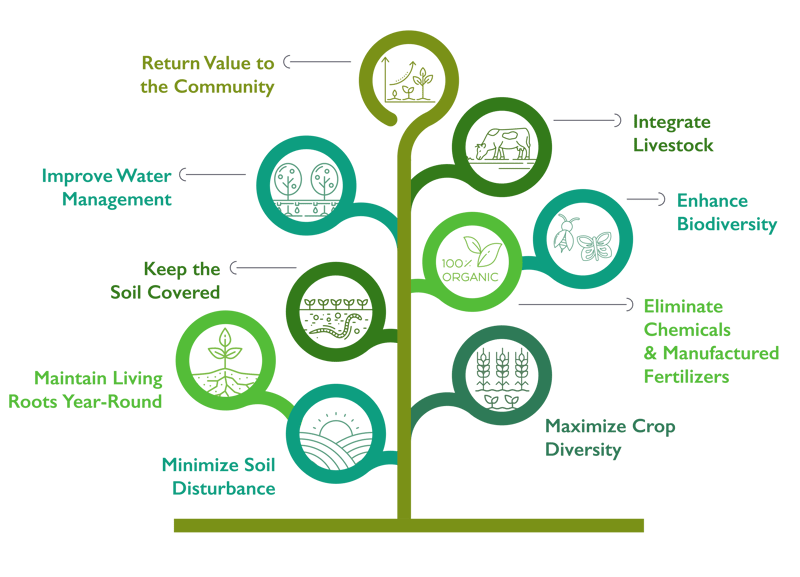

Focusing on regenerative agricultural practices and economically viable organic certification aligns financial returns with measurable environmental outcomes and the long-term resilience of farmland. Organic crops continue to earn price premiums of 20% to 100% above conventional prices. Regenerative practices protect those margins by improving soil health and reducing long-term asset-level risk.

Our Leadership

Lucerne has partnered with a Specialist Portfolio Manager and Investment Team who bring over a decade of institutional farmland investment experience, having successfully executed owner-operator annual and permanent crop strategies with consistent outperformance through cycles. The firm is led by Thijs Hovers, who brings extensive experience in fundamental investing and alternative asset management.

Founded in 2000, Lucerne Capital Management is a Greenwich-based investment firm specializing in alternative investments. Known for disciplined fundamental strategies, Lucerne's U.S. Farmland Platform provides turnkey access to high-quality permanent and specialty cropland investment strategies. We combine proprietary deal flow, rigorous agronomic due diligence, and direct operational oversight to capture value across market cycles.

Investment Philosophy

"Prioritize cash yield over speculative land appreciation."

Lucerne is redefining institutional farmland investment through operational excellence and transparent performance measurement. The Lucerne U.S. Farmland Platform targets double-digit returns through disciplined acquisitions of high-quality assets and active operational management.

Our focus:

- Water-secure geographies with proven agronomic quality and climate resilience

- Owner-operated permanent and specialty crops with regenerative conversion potential

- Direct operational control combined with strategic local grower partnerships

- Rigorous due diligence covering soil quality, water security, production history, and operator capabilities

- Active management to optimize crop marketing, maximize realized prices, and compound value through operational improvements

Our Straightforward Approach

Leverage operational expertise and proprietary deal flow to acquire undervalued farmland assets.

.png?width=800&height=161&name=Lucerne%20Farmland%20-%20Charts%20(1).png)

Lucerne Advantage

Built for selection and supervision, we curate and continuously monitor Specialist Managers, ensuring that every strategy is anchored in fundamentals and executed by superior talent.

Turn‑key access to a complex asset class.

Farmland is a specialist asset class that requires a Specialty Portfolio Manager with deep, specific experience. Transactions require local knowledge, nimble due diligence, and continuous operational oversight. Our alpha strategy offers investors a single, professionally managed vehicle, eliminating the need to directly own and operate farms or invest in unregulated standalone farmland investment shops.

Lucerne provides the institutional backbone for Specialist Managers:

- Institutional‑grade operations

- Capital markets access

- Scalable technology

- Institutional governance

- Fund monitoring

- Risk and compliance oversight

CONTACT US

Lucerne Capital Management, L.P.

73 Arch Street, 3rd Floor

Greenwich, Connecticut 06830

Investor Relations Contact:

Patrick Moroney

pm@lucernecap.com

+1 (203) 983-4400

DISCLAIMER

This white paper is for informational and educational purposes only and should not be construed as investment advice or an offer to sell securities. The information presented represents the views and opinions of Lucerne Capital Management as of the date indicated and may be subject to change without notice.

Past performance does not guarantee future results. Farmland investments involve risk, including potential loss of principal, commodity price volatility, weather-related impacts, water availability constraints, and operational risks. The return targets and performance statistics referenced herein are hypothetical or historical and are not guarantees or predictions of future performance.

Investors should carefully review all offering documents, including risk factors, before making investment decisions. Please consult your financial, legal, and tax advisors to determine the suitability of farmland investments for your portfolio.

The interests in the Lucerne U.S. Farmland Platform have not been registered under the Securities Act of 1933 and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.